Frequently Asked Questions

Credit Cards | Policybulls

A credit card is a financial tool that allows you to borrow money up to a pre-approved limit for purchases, which you can repay later. It also offers rewards, cashback, and other benefits.

When you use a credit card for payments, your bank/lender covers the expense, and you must repay it within the billing cycle (usually 30-50 days). If not paid in full, interest is charged on the remaining balance.

✅ Easy transactions – Use it anywhere for shopping, dining, travel, and more.

✅ Rewards & cashback – Earn points, discounts, and cashback on every spend.

✅ Interest-free period – Get up to 50 days of credit without interest.

✅ EMI conversion – Convert big purchases into affordable monthly EMIs.

✅ Build your credit score – Timely payments improve your CIBIL score.

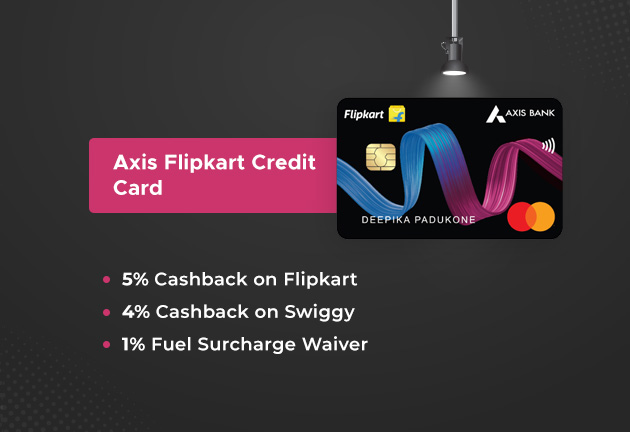

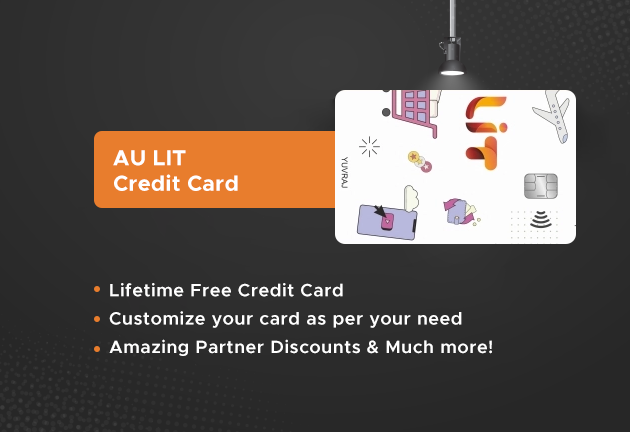

💳 Cashback Credit Cards – Earn cashback on purchases.

💳 Reward Credit Cards – Get reward points for every transaction.

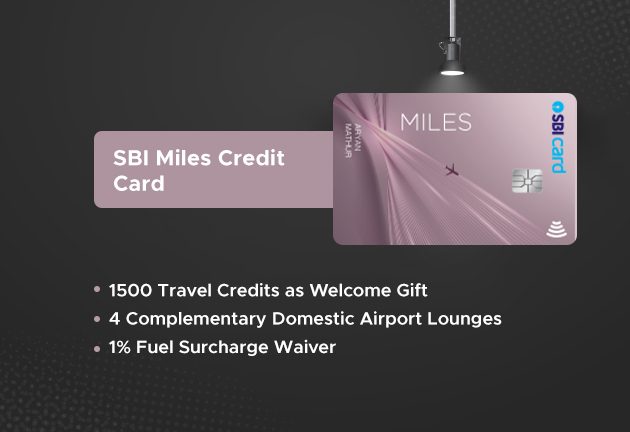

💳 Travel Credit Cards – Offers free lounge access, travel rewards & discounts.

💳 Fuel Credit Cards – Get fuel surcharge waivers & discounts.

💳 Shopping Credit Cards – Ideal for online/offline shopping with special offers.

💳 Business Credit Cards – Best for entrepreneurs & corporate professionals.

To qualify for a credit card, you generally need:

✔ Age: 21-60 years

✔ Minimum income: ₹15,000 - ₹50,000 per month (varies by card)

✔ CIBIL Score: 700+ (higher score improves approval chances)

✔ Employment type: Salaried or self-employed

Yes! Some banks offer secured credit cards (backed by FD) for those with a low credit score. You can improve your CIBIL score with responsible usage.

To increase your credit limit:

✔ Maintain a good repayment history

✔ Use your card regularly and responsibly

✔ Request a limit increase from your bank after 6-12 months

❌ Late payment fees

❌ Interest on the outstanding balance

❌ Negative impact on your CIBIL score

❌ Possible card suspension if overdue for a long time

Applying is simple!

✅ Visit Policybulls.com and choose a credit card.

✅ Submit your basic details & documents.

✅ Get approval & card delivery in just a few days!