Credit Score Report Absolutely FREE

- Reduce rates on your existing Loans.

- Suggest Better Rewards Credit Cards.

- Tips on Improving Credit Score.

- CIBIL requires accurate details to ensure accuracy & security.

- Make sure they match your banking records.

Worldwide Experience

We Always Try To Understand

Users Expectation

Active Customers

0

L+

Positive Feedback

0

%

Users

0

k+

Agents

0

+

What is a CIBIL Score

A CIBIL Score is a three-digit number that denotes your credit report. The CIBIL score starts from 300 to 900 and if you are closer to a CIBIL score of 900 then it is considered a good score. On the other hand, if your score is closer to 300 then it is a bad score and there are fewer chances to get any debt. Therefore it is necessary to keep an eye on your CIBIL Score by checking it regularly.

Difference Between a Credit Score and a CIBIL Score

CIBIL score is a Credit Score generated by a credit rating agency called TransUnion. TransUnion CIBIL is the gold standard of Credit Scores and the only one that counts while seeking finance. While there are several Credit Bureaus that issue credit scores, CIBIL is the one that holds most weight with banks. Now, a Credit Score is like your financial report card with a numerical representation of your credit health. A CIBIL score can range from 300 to 900 in India and CIBIL score above 750 is considered good for the approval of Loans & Credit Cards. While evaluating any sort of credit application, the lender checks your credit score and your credit history before going ahead with the application.

Therefore you can not point out a better score because every agency has its parameters to calculate the credit score and the Cibil TransUnion is one of them. Usually a Cibil Score of 750 and above is enough to get quick approval for a loan or debt.

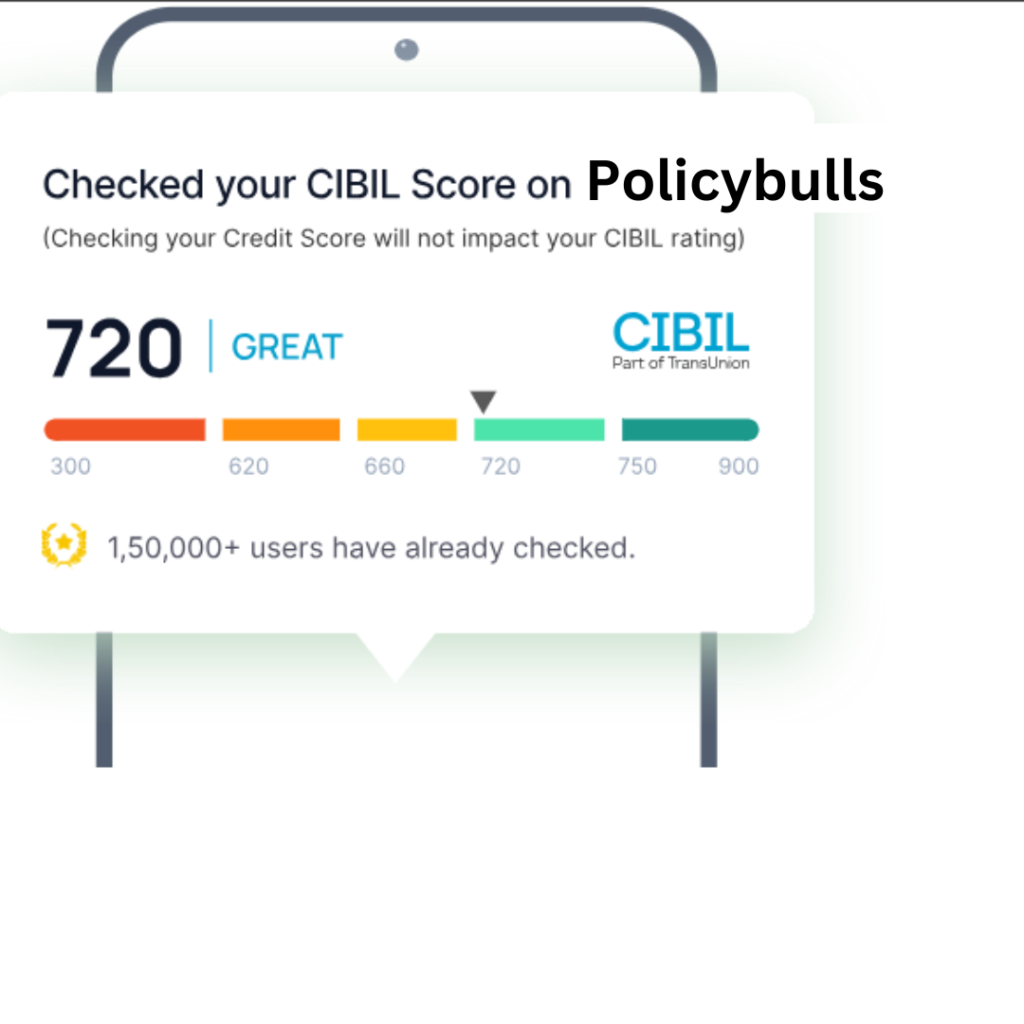

Credit Score – Check Free CIBIL Score Online

Policybulls is the best way to check your CIBIL Score for Free, as 6.5 million satisfied users have already been discovered! On Policybulls, you can check your CIBIL score every month for free without paying any charges for calculation. It is important to make a Cibil Check because banks look at your CIBIL Score before giving you any type of loan. Policybulls enables you to monitor your Credit Health and Credit History over time and take steps to improve it. You can also download the detailed CIBIL Report that allows you to check your credit repayment status, on-time EMIs, loan enquiries, and much more – at zero cost. If required, Policybulls also suggests financial products such as loans, credit cards, and balance transfers that may have a positive impact on your credit history.

What is the Full Form of CIBIL?

The Term Cibil stands for “Credit Information Bureau India Limited” and it is a company that is engaged in managing and keeping credit records of different companies, firms, and individuals based on which the lenders disburses the loan. The Banks and other lending institutions submit the information to Cibil based on which this company calculates the Cibil Score.

How to Check Free CIBIL Score Online at Policybulls?

Policybulls is the official partner of TransUnion for giving authentic and accurate CIBIL Scores. Policybulls gives you the original authentic CIBIL score free because we believe that good credit health is a stepping stone to enabling good finances for our customers. Another advantage is that Policybulls is free of cost no matter how many times you check Cibil’s score online (and not just for the first time). Also, checking your Score on Policybulls does not reduce your score or negatively impact it in any way – no matter how many times you check your score with us. This is why 6.5 million people have already checked their CIBIL Score online for free with Policybulls.

Plus, no need to do it again. Next time you want to check your score, all you have to do is log in to Policybulls with OTP using your registered mobile number, and you’re good to go!

And with best-in-class data security and privacy protocols, ease of staying credit healthy comes with complete security and peace of mind! You also have the choice of either logging into the Policybulls website and go to the CIBIL section or downloading the Policybulls app from the Android Google Playstore or Apple iOS Appstore. Additionally, there is an option to download your detailed CIBIL report easily. On the app, you can also track your progress over time by seeing your past scores.

How to Check CIBIL Score by PAN Card and Aadhaar Card?

Your PAN number enables Credit Rating Agencies to identify your credit records accurately. Hence, your PAN number is needed to check your Cibil Score. While checking your Cibil, keep your PAN Card handy and ensure that the Name and Date of Birth you enter match those on your PAN Card. Just follow these steps to check Cibil Score by PAN Card on Policybulls:

Navigate to ‘CIBIL Score’ on the Policybulls website

Provide PAN Card number

Enter your Name and Date of Birth as per PAN Card

Enter details such as gender, email address, residential address and mobile number

Submit to know your score

After following the above steps, you can easily have the Cibil score check free online by PAN Number.

If you are checking your Cibil Score through an Aadhar then you can use the Address present on your Aadhaar Card. Sometimes, while downloading a Cibil Report, you will need to provide your address and it should be as same as it is present on your Aadhaar Card.

How to Check Free CIBIL Score on WhatsApp?

Policybulls has been a pioneer in bringing financial services to India’s favorite communication platform – WhatsApp. For the first time in India, a user can even check their CIBIL Score using WhatsApp – no more forms! Checking CIBIL is now as easy as chatting with a friend.

All that a user has to do is give a missed call to +91 7533077352

You will receive a WhatsApp message from Policybulls

You will be asked a few questions such as

Your Full Name

Your PAN Number

Your Residential Address

Your Email Id

Is Policybulls an Official Partner of CIBIL?

Policybulls is first official fintech partner of TransUnion CIBIL (Credit Information Bureau of India), the company that issues the official CIBIL score Login to check the Cibil. This authorises Policybulls to present to you the score generated by TransUnion. At Policybulls, we are all about trust and transparency. So, here’s a link from CIBIL’s official website for your reference.

Does checking CIBIL Score multiple times affect overall Credit Score?

The short answer is – No if you are the one checking it. But we understand why people have this apprehension. So, it is important to understand the nuance.

On one side, CIBIL checks are requested by financial organizations to ascertain an individual’s creditworthiness and on the other, by individuals to monitor their credit health. When a person applies to a bank or other lending institutions for a loan or credit, the former scenario comes into play. That is, during the evaluation process, a CIBIL inquiry is triggered by the bank in the background, which happens without the involvement of the applicant. The loan approval decision is partly made based on that score. This is called a Hard Inquiry. Now, here’s the thing: every time you apply, the banks run an involuntary Credit Check – and that MAY affect your Cibil score adversely giving rise to this commonly held fear.

However, when individuals voluntarily check their Cibil score online on Policybulls for their consumption, their CIBIL Score DOES NOT get affected. So our simple advice to users does not keep applying for loans and credit cards without accurately knowing their credit situation. Because whether you do or not, banks will keep checking your score as often as you apply, which reduces your chances for loan approval by reducing your score.

You rather check your score on your own first – for free via Policybulls, safely, without affecting your score. So if your score is low, you see it before the bank does. Say your score is lower than 700, then you can improve your score over time by optimizing your credit situation and following the score-boosting advice given by Policybulls based on your score. If you are interested, Policybulls can also show you financial products with high approval probability so that you may fulfill your immediate need and get started on the path of healthy credit. Once you are confident about your score, you can apply in a more targeted manner, increasing the chances of disbursal and reducing the risk of multiple bank-initiated credit inquiries.

What are the benefits of having a good CIBIL Score?

Credit facilities, such as credit cards or loans, are provided based on a thorough check of numerous factors. These factors include your relationship with the lender, employment status and history, age, and more. Amongst these factors, CIBIL Score is considered as one of the most important factors. Banks evaluate your credit health and capacity for repayment based on your CIBIL Score. Therefore having a good CIBIL score not only helps you get approval in the first place but also affects the quality of debt available to you. A good Cibil score makes a person eligible for better deals on loans and credit cards.

But this does not mean that not having a good Cibil score currently makes you completely ineligible for all financial products. They may opt for secured loans such as loans against property, gold loans, etc by mortgaging their assets. But the options are still limited. Some banks and NBFCs may give loans or credit cards even with a CIBIL score of 0, -1, or a sub 600 score. But these may be at exorbitant rates of interest, offering very low credit limits and stringent repayment terms. The advantage of being on the green side of the scale is undeniable. Because getting a loan is not enough, getting one on good terms which you can viably service is more important. Here are some pros of maintaining a good Cibil score and have the Cibil Score check online for free.

Increases eligibility for loans – A higher Consumer Cibil Score means lenders will be more comfortable in lending you a bigger amount or providing you with a better credit limit.

Gives access to best Credit Cards – Some of the premium Credit Cards offer great benefits in addition to deals and offers. Most of these cards have a good CIBIL Score as a prerequisite.

Lower rate of interest – People wonder why they do not get a loan at the advertised lowest rate of interest. It could be because of a subpar cibil score in addition to other factors such as income, repayment capacity. Those having a positive payment history and a high score are more likely to get a lower rate on loans.

To build and maintain a credit history – Good credit health does not stop at getting a good score just when you need a loan. What you do with that loan and how you repay it affects your future score. Remember, it’s not a sprint, but a marathon. Maintaining a good cibil score, whether you are seeking a loan or not helps you maintain overall financial discipline. Paying credit card bills, EMI’s on time, not taking an excessive number of loans, and credit cards even though you can afford it now and your score allows it, sows the conditions for a future debt trap.

Please note that a 0 or -1 score is not necessarily bad. It only means you have zero credit history and cibil score. The moment you start using a credit card or paying EMIs, your credit history will build up and so will your credit score. This will make you eligible for better options in the future.

What is a Good CIBIL Report?

A CIBIL report is a single unified document that provides a detailed overview of your credit history across different lenders over a significant time period. It is a comprehensive report that provides details of an individual’s or corporate entity’s borrowing history and repayment record. The credit report includes the following information and you can download the free Cibil Report through Policybulls.

Personal details of an applicant (name, age, gender and address)

Employment details and earnings

Number of hard enquiries made by potential lenders on receipt of the loan/credit card application

Records of previous and current loans along with the payment record

Any defaults on loan

Total credit limit and the amount spent monthly (Credit Utilisation Ratio)

The details of settled loans, if any

Any credit card payment defaults

Credit Score

This report provides lenders detailed information on the applicant’s creditworthiness based on previous and current credit behavior. Based on the report, lenders take the lending decision. But more importantly, it provides you with an opportunity to analyze your credit habits and take corrective action if needed. Being aware is the first step to good financial health. As the number of loans and cards pile up, even the most disciplined among us can lose sight of our credit situation. And this is not to be taken lightly, because whether you like it or not, all your credit habits get recorded by financial institutions – it’s like karma. So, a CIBIL report is especially empowering because it helps you understand the workings of credit better and keeps you one step ahead.

How is CIBIL Report Generated?

Credit Information Bureau of India Limited (CIBIL), India’s first Credit Information Company, collects and maintains the records of an individual’s and non-individuals (commercial entities) credit-related transactions such as loans and credit cards. These records are provided by banks and other lenders every month to the Credit Bureau. Using this information, a Credit Information Report (CIR) and Credit Score are developed. When you check your score on Policybulls, you see this exact score and report generated by TransUnion.

How is Cibil Score Calculated?

The member banks and financial institutions report monthly the details related to the credit activity of the customers to the bureaus. This includes data of each loan or credit card repayment made by the customer during the period and even the late or skipped payments. The report comprises new loan applications, interest rates, the credit limit on cards, the status of all loan accounts including those ‘written-off’ or ‘settled’ or ‘closed’. After a complex statistical analysis of the provided information, the cibil score is calculated. Timely credit payments generally lead to a good score. Candidates with a high score have better chances of getting a loan or a credit card.

Factors Affecting CIBIL Score

This is one of the most commonly asked questions about CIBIL Check – ‘Which factors affect your CIBIL Score?’ The answer includes your credit history, payment date, number of unsecured loans, credit utilization, etc. explained in depth below.

Credit History: It is believed that roughly 30% of your CIBIL score depends on your repayment history and timely payment of your dues. Individuals not having any kind of credit history will most probably have a zero CIBIL score. But lenders also look at other factors such as your annual income and employment stability to estimate your repayment capability.

Missing of Due Dates: Your repayment discipline says a lot about your credit habits and repayment capacity and is used to gauge your creditworthiness. Any type of credit product comes with a designated due date. It is structured using things like EMI and regular credit card bills. Missing due dates even once or twice can affect your score. If it happens repeatedly, it will reflect in the credit report generated after every billing cycle and will be read as a pattern. This is terrible for your Cibil score and recovering from here becomes hard. So it’s important to cultivate a habit of timely repayment.

Utilization of Credit: Every person is eligible for a certain amount of credit from lending institutions based on his creditworthiness and factors like income and stability. This is reflected as a Credit Limit. The interesting thing is how much you utilize out of this credit limit also affects your future cibil score, because it gives lenders a sense of your money management skills, your propensity to spend using credit, your credit liability, and the risk to your solvency. It’s all about patterns. Credit Utilization is a metric that tries to capture the way you utilize your credit from the total given credit limit. It is calculated in percentage terms and is also known as the Credit Utilization Ratio. Suppose that you have a credit limit of INR 10,000 and you use only INR 3,000 from it, then your credit utilization ratio is 30%. From this, the lender can judge that despite having INR 10,000 available as credit, the borrower needed only 3000, hence is solvent and can easily pay back the loan. Borrowers who exhaust their credit limit frequently are known as Credit Hungry Borrowers, who find it difficult to get any kind of credit as they are considered a risk. A low credit utilization ratio (below 40%) usually contributes to a good Cibil score.

Multiple Credit Applications: The chances of your CIBIL score getting affected negatively are higher if you frequently apply for loans and credit cards. This is because lenders can sense desperation. You don’t want to be categorized as ‘Credit Hungry’ and thereby a high-risk proposition. Every time you apply for a loan or a credit card, the bank or lending institution triggers a hard inquiry and the applicant is penalized in his score. Most often, this is avoidable and your score unnecessarily suffers. It is better to have a Cibil check for free and only apply after you are confident of your score and apply for products that you are likely to be eligible for. Also, never apply for credit cards, again and again, to pay off old credit card debt. Not only will you be facing a debt trap, but also end up damaging your score making the situation worse. So look before you leap, check before you apply!

Increasing Your Credit Card Limit Frequently: Frequently requesting a raise in your credit card limit can create doubts about your creditworthiness. It can indicate that your debt appetite may overtake your repayment ability. This can negatively affect your CIBIL score. So, it is better to stay well within the existing credit limit and repay dues on time. When the time is right, the bank will voluntarily increase your credit limit as per their assessment.

How to Improve or Increase CIBIL Score?

A good Credit Score is like good health – there are only upsides and no downsides. Whether you choose to seek credit using it or not becomes secondary. The fact that it gives you access to healthy credit if and when you need it is a reassuring feeling. It only strengthens your financial options and keeps you on track though positive habit formation. To get the best deals on credit cards and loans, your score must be good. In India, banks and NBFCs would consider your application only if you have a good credit score. Once you understand the factors affecting your score, taking steps to improve it be it becomes easier. Here are some recommended measures to improve your CIBIL score:

On-time, Every-time’ Payments – Always pay your Credit Card Bills on time. Never miss the due date. Ensure that your EMI deductions are not delayed for any reason. This will demonstrate your credit discipline and establish your repayment credibility.

Debt Consolidation/Debt Optimization/Debt Restructuring – Why keep 4 credit cards and 3 loans running when you can make do with 2? A tight ship is easier to steer. Close down loan accounts and credit cards that you don’t use much. Say, you have been paying 36% interest on your Credit Card, it would be wise to take a Personal Loan at less than half the interest rate, pay off the Credit Card liability, terminate the card, and pay off the Personal Loan using more manageable EMIs. Also, look for options such as turning your Credit Card outstanding into EMI. This helps you stay clear of the debt trap and these smart decisions will reflect in an improving score. Bring down your Credit Utilization percentage and ensure a healthy ratio of secured to unsecured loans. It’s an ongoing process. Keep optimizing.

Utilize Balance Transfer Opportunities – This one is somewhat related to the earlier point but deserves a spot of its own. A balance transfer is shifting to another loan with better interest rates and terms. Why continue suffering the same product when better options become available? You can easily do so for products such as Personal Loans and Home Loans and reduce your liabilities, possibly shrinking your EMIs and expanding your Cibil Score! And it’s a virtuous circle – the more your score improves, the better the deals that become available to you. You can keep an eye on balance transfer offers that get unlocked depending on your score using Policybulls’s recommendation engine, every time you check your CIBIL for free on Policybulls!

No Credit History? Try for a Small Loan or a basic Credit Card – This may sound counterintuitive. But if you have no credit history yet ( and hence a 0, -1 score), it might be a good idea to start building one by applying for an entry-level credit product, even if you don’t need it. Why? Because you have to start somewhere and you don’t want to be stuck with no cibil score when you need finance. But a word of caution – don’t get carried away. Just because a loan with a high credit limit is available does not mean you take it. Opt for something which is manageable and involves regular repayment, so that you can establish a positive repayment pattern. You can move on to the big stuff when your Cibil Score gets going as fast as your career!

Why is my CIBIL Score zero or negative? What does a CIBIL Score of 0, -1, 1 to 5 mean?

Seeing 0, negative, or a single-digit CIBIL Score can be alarming for new borrowers. In most cases, there is no reason to worry, but definitely, some reason to take constructive action. As explained in the earlier point, such scores indicate that the individual has no credit history or an inadequate one.

A CIBIL Score of 0 indicates NH or No history, i.e., no records of the borrower can be found. A CIBIL Score of -1 means that the credit history of the borrower is NA or not available. It may also imply an inadequate credit record or that fewer than 6 months’ worth of records is available (not enough to generate a score).

A CIBIL score ranging from 1-5 denotes the magnitude of risk that a lender may face while lending to a fresh borrower. 5 means less risk. 1 means more risk.

Why is my CIBIL Score is not getting generated?

Sometimes people raise queries like “Why am I unable to check my Cibil Score?”. So it can be due to many possible reasons. The systems at TransUnion identify you and your records based on the details that exist in your banking records. Often this information is provided by you to banks a long time ago. Details like phone numbers, addresses, employment details change with time but are often not updated in your banking records. Sometimes while filling the CIBIL form, one puts in the latest details or the details he can recall. But if there’s a mismatch with the banking records, as a privacy feature, CIBIL does not show you the score, because it has not been able to identify you with sufficient certainty. In such cases, it is best to review all details in your banking records and write to CIBIL using the contact us page on their official website. If there is a discrepancy, only they can help rectify it.

Frequently Asked Questions (FAQs)

How to Find the Exact Cibil Score?

You can find the exact Cibil Score on Policybulls by providing your basic details. All you need is to enter your name, PAN, City, Income, Employment Status, Mobile Number, Email ID, and Date of Birth to find the exact Cibil Score. If your score is 750 and above then you can easily apply for credit cards, personal loans, home loans, and other types of loans.

What is Cibil Score for Loan

If you are applying for a personal loan, home loan, or any other loan then you will need a minimum Cibil Score of 750 for easy approval. Some lenders can even lend you a loan at a score of 750 but the eligibility criteria will be difficult and you will need a high and stable income to get the loan. So, the best Cibil Score for Loan is 750 and above.

What is the minimum CIBIL Score for home loan and minimum CIBIL Score for personal loan?

720 or above is the minimum required CIBIL score for home loan. Whereas the minimum required CIBIL score for personal loan is 750 or above. However, if your CIBIL score lies between 700 to 750, there are chances that your loan application might get approved. However, if you have a low CIBIL score, you would still be able to avail a personal loan at a higher interest rate and a higher income proof would be required.

Why There is a Need for a PAN Card to Check the Credit Score?

If you want to get accurate information about the Credit Score then it is necessary to provide your PAN details. A PAN card just acts as a proof of identity that is stored in the database of the Credit Score Bureaus. That is why you need a PAN card to check the Cibil Score because it proves your identity to the bureau.

How Should I Improve my Credit Score?

You can improve your credit score through following ways:- - Make Payment of your Loan EMIs on time. - Never skip a single EMI of your loan. - Clear your credit card bills on time. - Avoid unnecessary loans or credit cards. - Maintain a Credit Utilisation Ratio of less than 30%.